Are retirees worse off now than in prior generations?

Many older workers long for the "good old days," thinking that somehow things were better for prior generations of retirees. That line of thinking is a natural consequence of the decline of steady jobs that came with good health insurance and retirement benefits. Those once-routine perks made it possible for many middle-income workers -- both blue and white collar -- to have a long career and retire fully in their early 60s to a life of leisure.

While the loss of those workplace benefits has diminished the lives of millions of older workers, are today's retirees actually better off or worse off than prior generations? The answer depends in part on how you define "better off."

Why many older workers and retirees are worse off

There's no doubt that the prevalence of traditional defined-benefit pension plans and employer-sponsored retiree health plans has declined significantly in the past few decades. Together with Social Security and Medicare, these plans enabled many older workers to retire full-time in their late 50s or early 60s without having to worry very much about paying for medical bills or running out of money before they died.

But the decline of these plans, coupled with the doubtful sustainability of America's current Social Security and Medicare systems, feeds the negative perception that today's retirees are worse off than prior generations.

Today those traditional pension plans have been replaced by 401(k)s, for which you have the responsibility of deciding if you have enough money to retire and also for investing and managing that money to last the rest of your life. But less than half of the U.S. workforce was employed by large corporations and governments that sponsored those traditional pension plans. To earn significant benefits under these plans, you needed to remain with that employer for 20 years or more.

As a result, it's really just a small percentage of workers who "lost" significant traditional retirement benefits -- a number that's much less than half of the total workforce. The balance of workers were employed at small businesses with little or no retirement benefits, or they changed jobs too frequently to earn sufficient benefits to enable them to retire.

The same workers who were eligible for their employer's pension plans back in the day were often also eligible for continuing medical coverage in retirement through their employer. But today, your employer most likely doesn't offer that benefit if you retire before age 65 (Medicare's eligibility age).

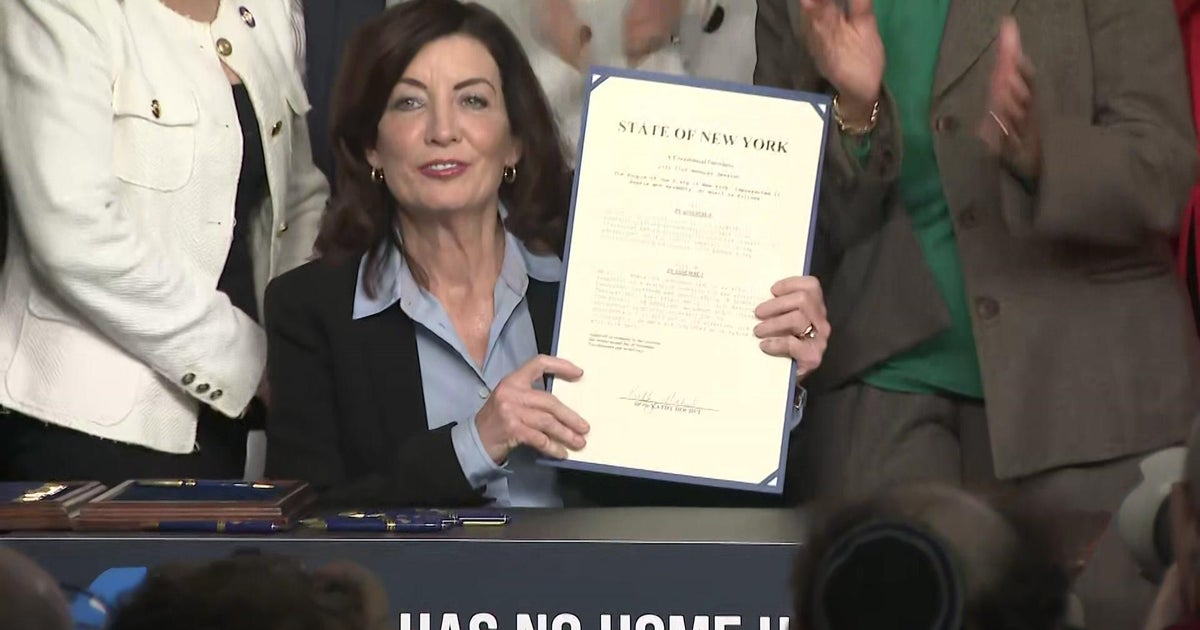

As a result, you'll need to shop for medical insurance on your own. Until recently, Obamacare allowed you to buy health insurance without worrying about being excluded for preexisting conditions. But that lifesaver is in doubt with the repeal of the Affordable Care Act a top priority of the Republican Congress and Trump administration.

An uneven housing recovery has also added to the uneasiness about retirement. Many homeowners in popular urban areas have seen their property value increase since before the Great Recession, but values for many others remain stagnated or even depressed. This is important only if you plan to use your home equity to finance your retirement, but not many retirees actually do.

Finally, plenty of evidence shows that millions of older Americans are approaching their retirement years with inadequate financial resources. That means they'll need to work longer and spend less, compared to prior generations of retirees.

These are indeed important and serious challenges, but they focus narrowly on economic issues.

Why some older workers and retirees are better off

Let's start with one key measure of quality of life: the length of your life. Many older workers can expect to live five to 10 years longer compared to prior generations. This is a significant improvement if you agree that being alive is better than being dead.

In addition, we didn't just extend the period of being frail and dependent -- many of those extra years are spent being healthy and active. However, these life expectancy gains often accrue to people with higher educational attainment and higher income, and that leaves out a large portion of the population.

Evidence also shows that more older Americans are working longer and spending more, compared to prior generations. This is good news for those approaching their retirement years with inadequate financial resources because they may have the opportunity to keep earning what they need to support themselves.

Also, there are provocative indications that working longer can help you stay healthy and avoid cognitive decline longer, so maybe it's not so bad that boomers need to work longer for economic reasons.

Moving beyond pure economic benefits, today's retirees might be considered better off than prior generations for several reasons:

- Breakthroughs in science improved the odds of extending healthy years through exercise, proper nutrition and social engagement.

- Technology has made it easier to stay in touch with far-away grandchildren, relatives and friends.

- Technology has also provided us with access to much more information that can help us successfully navigate many aspects of our lives. For example, we can easily view weather forecasts and traffic reports, and shop efficiently for goods and services that can be delivered to our doorstep.

- Medical science has created drugs that help keep us alive by addressing such common conditions as high blood pressure, cholesterol and diabetes (albeit with financial and dependency costs).

- Today's grandparents appear to be more connected with their adult children and grandchildren, compared to prior generations, giving them essential social connections and purpose.

- Americans have more opportunities now to create communities and find support through senior advocacy groups, such as AARP, Area Agencies on Aging and the Villages Movement.

Author Courtney Martin recently spoke at the Stanford Center on Longevity's Distinguished Lecture series about her recent book, "The New Better Off: Reinventing the American Dream." She advocates that "Americans of all ages think beyond purely economic terms when they consider if they are better off than prior generations."

To take Martin's advice, boomers will need to reinvent the American retirement dream to address the significant economic challenges they face. Part of this reinvention involves broadly considering all aspects of what it means to have a good life in your retirement years.